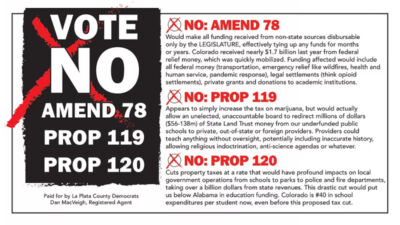

Just Vote No

These issues are written by lobbyists to defund our schools.

Read the Blue Book for pros and cons.

The Colorado State Central Committee voted overwhelmingly to oppose all measures.

Amendment 78: Legislative Authority for Spending State Money.

Would amend the constitution to make all funding received from non-state sources (ie, the Federal Government, private donations to universities, etc) disbursable only by the LEGISLATURE, effectively tying up those funds for months or years. Colorado received nearly $1.7 billion last year from federal relief money, and the Polis Administration was able to quickly and effectively deploy it. This Amendment would hobble such efforts.

In additional to federal money disbursements (for transportation, emergency relief such as flooding or wildfires, health and human services) this would affect legal settlements (think opioid settlements), grants and donations to academic institutions.

It is estimated this amendment would cost an additional $1 million plus in predicted staff requirements for the Legislature to even begin to account for these funds.

Proposition 119: Learning Enrichment and Academic Progress Program

This proposition, which appears to simply increase the tax on legal marijuana products, would also redirect millions of dollars from the State Land Trust from public funds to private, out-of-school providers, potentially giving them to out-of-state or even foreign companies with no accountability. An unelected and unaccountable board, operating without oversight, would have access to our public funds.

Our schools are some of the most poorly funded in the nation. These private programs / providers would syphon off almost $56 million in the first year, growing to $138 million by 2024/25.

As concerning, private providers could then do whatever they choose: teach inaccurate history lessons, allow religious indoctrination, pursue anti-science agendas.

For more info, and some excellent graphics, see NoOnProp119.com.

Proposition 120: Property Tax Assessment Rate Reduction

This would reduce residential property tax assessments from 7.15% to 6.5%, and for all other property from 29% to 26.4%. Lower taxes are always appreciated, but this would put us below ALABAMA. We are #40 in school expenditures per student.

There is considerable language confusion in this proposition that will determine which properties will actually be affected.

Courtesy of La Plata Democrats